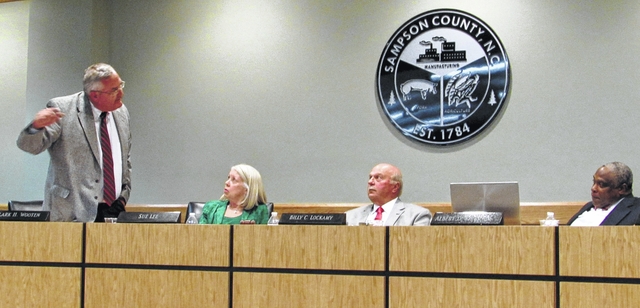

The decibel level heightened in the County Auditorium this week over business personal property compliance review appeals, with a reduction in late penalties causing voices to raise between two commissioners.

Three appeals were heard, encompassing $18,740 in late list penalties. Each was heard individually and Commissioner Clark Wooten ultimately made a motion that each of the taxpayers be released from 50 percent of the penalty.

“Given the fact we have not been doing our due diligence on our part and the taxpayers’ part, and we have finally come to a position where (we are) and these 18 or 19 people are the first people sought out,” Wooten said after the first appeal, “I make a motion we release 50 percent of the penalty. This is the first time we’ve done this.”

“That’s where my heart is at,” Wooten continued.

The motion was seconded by Commissioner Sue Lee. Chairman Billy Lockamy was also in favor. The vote came 3-2, with Commissioners Albert Kirby and Harry Parker dissenting.

Wooten made a similar motion following the second appeal, again seconded by Lee. Kirby took issue.

“What are we going to say when people come up here next year and say they want a 50 percent reduction?” Kirby queried.

In the midst of a delayed budget approval in July 2014, the board directed staff to explore conducting business personal property audits, also called compliance reviews, as the need for additional revenue was never greater.

Extensive discussions were held in the following months involving the county board, N.C. Department of Revenue representatives and local tax officials. Everyone expressed the need to ensure fairness and accountability among taxpayers. However, the board deferred a decision on conducting the reviews until after an educational blitz was done to make citizens aware of the requirements for listing business personal property.

In April 2015, after the education campaign was complete, the board unanimously directed the Sampson County Tax Office to utilize existing staff to carry out its legal obligation to value all taxable property in the county, assist taxpayers with the valuation of their property and conduct compliance reviews if necessary.

“I think when you have a good taxpayer who files every year on time and pays his taxes on time, with probably 700 or 800 assets, and he’s only failed to list these,” said CPA Linda Stewart, speaking on behalf of one of the taxpayers at Monday’s board meeting, “I think he has a good history.”

Kirby said he understood that, but it was establishing a bad precedent.

“If we do this for everybody, what has it done to our audit system?” he asked. “I don’t think we can look (other taxpayers) in the eye and say ‘well, these are the first ones, so they got a 50 percent reduction on their penalties.’ I think this is a dangerous precedent. If you do it for one, you have to do it for all.”

Again, the vote came 3-2.

The third and final appeal received the same motion from Wooten.

“I’m not intending on setting a precedent here,” he said, replying to Kirby’s concerns.

“You can’t be a little bit pregnant. You’re either pregnant or not,” Kirby said. “You can’t say ‘I’m going to do a business tax audit’ and then the first year when people start to fuss … if I was an individual I would say give me the same break. How can we look at other hard-working citizens of our county who pay their taxes on time and say ‘sorry?’”

The penalties are there for a reason, Kirby noted. He said eliminating the consequences for late payment will have “gutted the tax audit program you’ve put in place.”

“There’s no way to justify 50 percent now and not give it to people in the future,” said Kirby. “There’s no way.”

The vote again came 3-2 approving a reduction of the penalty, again Kirby and Parker dissenting.

Chairman Billy Lockamy said he could see Kirby’s position, but felt the first 18 compliance reviews was “a training program” for Sampson County.

“I agree with Mr. Kirby that is not really fair for the ones that will come down the road and will have to pay,” Lockamy stated. “We’ve done everything we know how to do to let people know this business audit was coming.”

That included the board’s approval early this year of $7,000 — actually spending $4,000 — to conduct that educational campaign, offering public sessions with a hired tax firm, passing out brochures and answering questions about the importance of properly listing property.

Following the board’s votes on the three appeals, Wooten said such negotiations are not out of the ordinary in these matters.

“In today’s world of small business, it’s tough to keep up with the letter of every regulation and law,” said Wooten. “You say you’re taking the teeth out of it, but not really. It’s a bite, what these people are going to have to pay in penalties. I’m so thankful we have people like Mr. Kirby who are 100 percent sure they are paying every bit of the taxes he should be paying …”

“And if I’m not, I’ll pay every penny I owe,” Kirby interjected.

“Are you going to let me have the floor or are you going to take it away from me?” said Wooten, who leapt to his feet. “I’ll tell you what, let me yield to you. You’ve had your say, but let me yield to you. Why don’t you tell us some more how everyone should be dead on the money. I’m not even sure I’m paying all my taxes. If I’m not, Ill tell you right now I’m not going to come and ask for any reduction in the penalty.”

He mentioned that one of the taxpayers had a center-pivot irrigation system that was unlisted.

“I have 42 of them,” said Wooten, still standing. “Can I tell you I have every damn one of them listed? Absolutely not. But when my time comes, I’ll cough it up. It’s easy for us to sit here, slam our hand down and say everybody should be paying their taxes, but some don’t know. I’m giving them the benefit of the doubt. Now I yield the floor to you.”

Kirby said he agreed with Wooten, and he would pay everything he owed, including the full penalty if there was one.

“I would never walk in here and say ‘other people have been paying their taxes, but I didn’t pay (mine), so give me a break,” said Kirby, his voice raising. “You’re not going to get any sympathy from me. Some of these guys are wealthy farmers with a lot of money. We are struggling to get money and you have people not listing taxes? We all have to pay our taxes and we have to pay them on time or deal with the consequences.”

“Whether it’s by mistake or not, if it’s not done, it’s got to be made right,” he concluded.

Commissioner Sue Lee said she went along with the 50 percent reduction with the idea that the taxpayers are still paying their full taxes and then some, the penalty is just not as severe. County manager Ed Causey said he felt the compliance review program had gone “smooth” so far, but wanted to continue the education process.

Another public training session is set for 6-8 p.m. Jan. 5.